www.irs.gov/newsroom Public Contact: 800.829.1040

Watch Out for Tax Scams as Filing Season Opening Nears

IRS YouTube Videos:

Tax Scams: English | Spanish | ASL

ID Theft: Are You a Victim of Identity Theft? English | Spanish | ASL

ID Theft: Protect Yourself From Identity Theft English | Spanish | ASL

ID Theft: IRS Efforts on Identity Theft English | Spanish

IRS Issues Urgent Warning to Beware IRS/FBI-Themed Ransomware Scam

IRS YouTube Videos:

Tax Scams: English | Spanish | ASL

Private Collection of Overdue Taxes: English | Spanish

IR-2017-134, Aug. 28, 2017

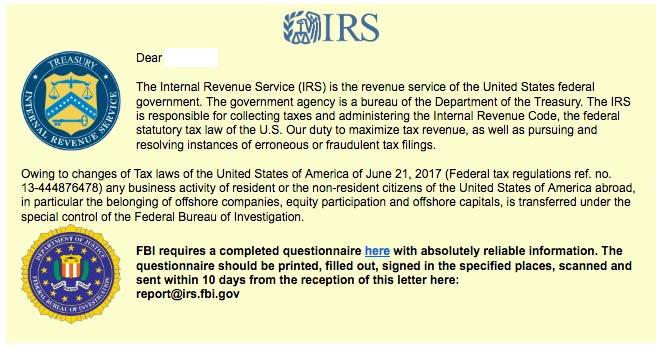

WASHINGTON – The Internal Revenue Service today warned people to avoid a new phishing scheme that impersonates the IRS and the FBI as part of a ransomware scam to take computer data hostage.

The scam email uses the emblems of both the IRS and the Federal Bureau of Investigation. It tries to entice users to select a "here" link to download a fake FBI questionnaire. Instead, the link downloads a certain type of malware called ransomware that prevents users from accessing data stored on their device unless they pay money to the scammers.

"This is a new twist on an old scheme," said IRS Commissioner John Koskinen. "People should stay vigilant against email scams that try to impersonate the IRS and other agencies that try to lure you into clicking a link or opening an attachment. People with a tax issue won't get their first contact from the IRS with a threatening email or phone call."

The IRS, state tax agencies and tax industries – working in partnership as the Security Summit – currently are conducting an awareness campaign called Don't Take the Bait, that includes warning tax professionals about the various types of phishing scams, including ransomware. The IRS highlighted this issue in an Aug. 1 news release IR-2017-125 Don't Take the Bait, Step 4: Defend against Ransomware.

Victims should not pay a ransom. Paying it further encourages the criminals, and frequently the scammers won't provide the decryption key even after a ransom is paid.

Victims should immediately report any ransomware attempt or attack to the FBI at the Internet Crime Complaint Center, www.IC3.gov. Forward any IRS-themed scams to phishing@irs.gov.

The IRS does not use email, text messages or social media to discuss personal tax issues, such as those involving bills or refunds. For more information, visit the "Tax Scams and Consumer Alerts" page on IRS.gov. Additional information about tax scams is available on IRS social media sites, including YouTube videos.

If you are a tax professional and registered e-Services user who disclosed any credential information, contact the e-Services Help Desk to reset your e-Services password. If you disclosed information and taxpayer data was stolen, contact your local stakeholder liaison.

The IRS Impersonation Telephone scam is still ongoing.

- If you know you owe taxes or you think you might owe taxes, call the IRS at 1.800.829.1040. The IRS employees at that line can help you with a payment issue, if there really is such an issue.

- The Treasury Inspector General for Tax Administration (TIGTA) is the lead agency for this scam. Contact TIGTA to report the call. Use their "IRS Impersonation Scam Reporting" web page or call 800-366-4484.

If you've been targeted by this scam, you should also contact the Federal Trade Commission and use their "FTC Complaint Assistant" at FTC.gov. Please add "IRS Telephone Scam" to the comments of your complaint.

IRS Warns Taxpayers of Numerous Tax Scams Nationwide; Provides Summary of Most Recent Schemes

Identity Theft Prevention Advice - FREE!

During the 2015 tax filing season our office has had two or three incidents where our clients were victims of Identity Theft. Their Social Security numbers were used by someone else to file a tax return. This required a considerable amount of time and effort on their part and ours, before we were able to file their 2014 income tax returns. A corporate attorney developed the following tips after personally experiencing the exasperation of Identity Theft.

- Do not sign the back of your credit cards. Instead, put PHOTO ID REQUIRED.

- When you are writing checks to pay on your credit card accounts, DONOT put the complete account number on the 'For' line. Instead, just put the last four numbers. The credit card company knows the rest of the number, and anyone who might be handling your check as it passes through all the check processing channels won't have access to it.

- Put your work phone # on your checks instead of your home phone. You have a PO Box use that instead of your home address. If you do not have a PO Box, use your work address. Never have your SS# printed on your checks. (DUH!) You can write it on if necessary. But if you have It printed, anyone can get it.

- Photocopy the contents of your wallet. Do both sides of each license, credit card, etc. You will know what you had in your wallet and all of the account numbers and phone numbers to call and cancel.. Keep the photocopy in a safe place. It is also a good idea to carry a photocopy of passport when traveling either here or abroad. We've all heard horror stories about fraud that's committed on us in stealing a Name, address, Social Security number, and credit cards.

Here's some critical information to limit the damage in case this happens to you or someone you know:

- We have been told we should cancel our credit cards immediately. But the key is having the toll free numbers and your card numbers handy so you know whom to call. Keep those where you can find them.

- File a police report immediately in the jurisdiction where your credit cards, etc., were stolen. This proves to credit providers you were diligent, and this is a first step toward an investigation (if there ever is one).

But here's what is perhaps most important of all:

- Call the 3 national credit reporting organizations immediately to place a fraud alert on your name and also call the Social Security Administration's fraud line number. The alert means any company that checks your credit knows your information was stolen, and they have to contact you by phone to authorize new credit.

Here are the numbers you always need to contact if your wallet has been stolen:

- Equifax: 1-800-525-6285

- Experian (formerly TRW): 1-888-397-3742

- Trans Union : 1-800-680 7289

- Social Security Administration (fraud line): 1-800-269-0271

Links to information on the Affordable Care Act (Obamacare)

For our customers who are under age 65: http://drakehealth.com/site/svc/egateway?sid=40946

For our customers who are 65 or older: http://drakehealth.com/site/svc/egateway?sid=40946&AGE=65

Identity theft and security of personal identity information is a real and serious threat. We have received several calls from clients in recent weeks, who have received phone calls and email claiming to be from the Internal Revenue Service. These calls and emails claim that the IRS has found errors or some issue in their tax reporting. The calls usually follow a storyline that either offers a substantial increase in refund; or a considerable tax penalty. The refund caller will then try to obtain personal identity information such as Social Security Numbers, bank account numbers or financial account data that will allow them to have access to these areas in order to make direct deposit of the refund. Once they have access to the accounts they drain them of cash or use them to set up large loans or mortgages on the taxpayers home. By the time the taxpayer realizes there is a problem the call is long gone with the taxpayers assets. The tax penalty caller will try to convince the taxpayer that they are in danger of immediate seizure of their bank accounts, investments or their home. One of our clients was threatened with arrest within 30 minutes if they did not go immediately to purchase money orders and have them ready for an agent to pick up.

THE IRS DOES NOT MAKE PHONE CALLS OR SEND E-MAIL FOR REFUNDS OR COLLECTIONS. Taxpayers may receive a letter when the IRS stops suspicious tax returns that have indications of being identity theft but contains a real taxpayer's name and/or Social Security number. If you receive any type communication purporting to be from the IRS and you are uncertain how to handle it, we can help you use the IRS Identity Verification Service to validate the letter or to help you report fraudulent activity.

Statement from a Treasury Spokesperson on CMS Announcement Last Week about 1095-A Forms:

Last week, CMS announced that about 20 percent of the tax filers who purchased health insurance from the federal Marketplace received statements (or form 1095As) that include an incorrect piece of information. Treasury estimates that approximately 50,000 tax filers (or less than 0.05% of total tax filers) already have filed their taxes using these incorrect form 1095As. We have concluded that these individuals do not need to file amended returns. The IRS will not pursue the collection of any additional taxes from these individuals based on updated information in the corrected forms. Nonetheless, some individuals may choose to file amended returns. A tax filer is likely to benefit from amending if the 2015 monthly premium for his or her second lowest cost Silver plan (or "benchmark" plan) is less than the 2014 premium. For example, if a filer's original form lists a benchmark premium of $100 and her updated form lists a premium of $200, it may be in her interest to refile. Individuals may want to consult with their tax preparers to determine if they would benefit from filing amended returns. As CMS announced last week, affected individuals who have not yet filed their taxes should wait to file until they receive their corrected forms.

www.irs.gov/newsroom Public Contact: 800.829.1040

Watch Out for Tax Scams as Filing Season Opening Nears

IRS YouTube Videos:

Tax Scams: English | Spanish | ASL

ID Theft: Are You a Victim of Identity Theft? English | Spanish | ASL

ID Theft: Protect Yourself From Identity Theft English | Spanish | ASL

ID Theft: IRS Efforts on Identity Theft English | Spanish

Podcasts

ID Theft: Protect Yourself from Identity Theft English | Spanish

ID Theft: Are You a Victim of Identity Theft? English | Spanish

IR-2014-5, Jan. 23, 2014

WASHINGTON — With the start of the 2014 tax season approaching on Jan. 31, the Internal Revenue Service urged taxpayers to be aware that tax-related scams using the IRS name proliferate during this time of year.

Tax scams can take many forms, with perpetrators posing as the IRS in everything from

e-mail refund schemes to phone impersonators. The IRS warned taxpayers to be vigilant of any unexpected communication that is purportedly from the IRS at the start of tax season.

The IRS encourages taxpayers to be on the lookout for phone and email scams that use the IRS as a lure. The IRS does not initiate contact with taxpayers by email to request personal or financial information. This includes any type of electronic communication, such as text messages and social media channels. The IRS also does not ask for personal identification numbers (PINs), passwords or similar confidential access information for credit card, bank or other financial accounts. Recipients should not open any attachments or click on any links contained in the message. Instead, forward the e-mail to phishing@irs.gov.

Additional information on how to report phishing scams involving the IRS is available on the genuine IRS website, IRS.gov.

In addition, the IRS continues to aggressively expand its efforts to protect and prevent refund fraud involving identity theft as well as work with federal, state and local officials to pursue the perpetrators of this fraud.

The IRS offers several suggestions for taxpayers to help protect themselves against scams and identity theft:

- Don't carry your Social Security card or any documents that include your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Don't give a business your SSN or ITIN just because they ask. Give it only when required.

- Protect your financial information.

- Check your credit report every 12 months.

- Secure personal information in your home.

- Protect your personal computers by using firewalls and anti-spam/virus software, updating security patches and changing passwords for Internet accounts.

- Don't give personal information over the phone, through the mail or on the Internet unless you have initiated the contact and are sure of the recipient.

For more information, see the special identity theft section on IRS.gov and IRS Fact Sheet 2014-1, IRS Combats Identity Theft and Refund Fraud on Many Fronts.

Taxpayers also should be very careful when choosing a tax preparer. While most preparers provide excellent service to their clients, a few unscrupulous return preparers file false and fraudulent tax returns and ultimately defraud their clients. It is important to know that even if someone else prepares your return, you are ultimately responsible for all the information on the tax return.

Refer to our Tips to Help you Choose a Tax Preparer for the upcoming 2014 Tax Season starting Jan. 31.

IRS Warns of Pervasive Telephone Scam - Click to view document

1. You can order copies of your tax return or tax account transcript quicker and easier. You also have two ordering methods – phone or mail.

If you are a student who needs a copy of your tax return transcript for a financial aid application, a potential home buyer needing to verify your income, or if you need information from your tax account, ordering that information is now quicker and easier.

To request your free transcripts call the new toll-free number (1-800-908-9946) and follow the message prompts, or complete IRS Form 4506T, Request for Transcript of Tax Return, and mail it to the address listed in the instructions.

You should receive your transcript in fewer than two weeks. For mailed requests, please allow up to 30 days.

If you need an exact copy of a previously filed and processed tax return with attachments (including Form W-2), you should complete Form 4506, Request for Copy of Tax Return, and mail it to the addressed listed in the instructions, along with a $57 fee for each tax year requested. Copies are generally available for returns filed in the current year and going back six years.

Please keep this valuable information in mind in case you, or someone you know need a copy of a tax document. The process has been improved to better serve taxpayers.

Tax Package Mailing for Individuals to End Following Growth of e-File

Individual and business taxpayers will no longer receive paper income tax packages in the mail from the IRS. These tax packages contained the forms, schedules and instructions for filing a paper income tax return.

The IRS is taking this step because of the continued growth in electronic filing and the availability of free options to taxpayers, as well as to help reduce costs. In early October, the IRS will send a postcard to individuals who filed paper returns last year and did not use a tax preparer or tax software. The information will explain how to get the tax forms and instructions they need for filing their tax year 2010 return. The forms and instructions will be available in early January 2011.

3. Publication 4845, Key Points about Residential Energy Credits, is now available in Spanish, Chinese, Vietnamese, Korean, and Russian. The flyer highlights key points about the Nonbusiness Energy Property Credit and the Residential Energy Efficient Property Credit.

4. IRS Provides Relief for Homeowners with Corrosive

Drywall

The Internal Revenue Service has announced issuing guidance providing relief to homeowners who have suffered property losses due to the effects of certain imported drywall installed in homes between 2001 and 2009. Revenue Procedure 2010-36 enables affected taxpayers to treat damages from corrosive drywall as a casualty loss and provides a ”safe harbor” formula for determining the amount of the loss.

5. The IRS has issued a draft Form W-2 for 2011, which employers use to report wages and employee tax withholding. The IRS also announced that it will defer the new requirement for employers to report the cost of coverage under an employer-sponsored group health plan, making that reporting by employers optional in 2011.

6. Phishing and tax scams: don't fall for them

- The IRS does not request detailed personal information through e-mail.

- The IRS does not send e-mail requesting your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts.

- Report suspicious e-mails and bogus IRS Web sites to phishing@irs.gov.

- Current fraud risk related to EFTPS

If you receive an e-mail from someone claiming to be the IRS or directing you to an IRS site,

- Do not reply.

- Do not open any attachments. Attachments may contain malicious code that will infect your computer.

- Do not click on any links. If you clicked on links in a suspicious e-mail or phishing Web site and entered confidential information, visit our Identity Theft page.

- Use the following steps to report the e-mail or bogus Web site to the IRS.

- Forward the e-mail or Web site URL to the IRS at phishing@irs.gov. You can forward the message as received or provide the Internet header of the e-mail. The Internet header has additional information to help us locate the sender.

- After you forward the e-mail or header information to us, delete the message.